2017 income tax malaysia

PwC 20162017 Malaysian Tax Booklet Income Tax 4 Offences penalties Part VIII of the ITA 1967 prescribes for various offences and penalties which include the following. Income range Malaysia income tax rate 2017.

Business Income Tax Malaysia Deadlines For 2021

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from.

. Aniq was a non-resident in Malaysia for the basis year for the YA 2017 as he was present in Malaysia for less than 182 days in the year 2017. Income tax rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Malaysia Luther News February 2017 Malaysia Enacts Finance Act 2017.

For residents tax is paid on a sliding scale - so the. Allowable expenses a b. 9 Order 2017 The above order gazetted on 24 October 2017 exempts a NR from payment of tax on income under sections 4Ai ii which is rendered.

46 days His employment income for YA 2017 is tax exempt as he is not resident not physically present in Malaysia for at least 182. RM20000 - RM35000. Computation of Total Income for the Year of Assessment 2017 Details RM RM Rental a Factory Shah Alam b Factory Klang vacant 300000 Nil 300000 Less.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. On the First 2500. Malaysian ringgit.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. 01092017 to 15092017 15 days employment Total. On 23 December 2016 Malaysia issued the Income Tax Rules 2016 to implement CbC reporting requirements in.

Income that a non-resident derives from Malaysia from special classes of income is subject to tax in Malaysia. A qualified person defined who is a knowledge worker residing in Iskandar. Corporate - Taxes on corporate income.

Calculations RM Rate TaxRM 0 - 5000. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART II QUALIFYING EXPENDITURE FOR PURPOSES OF CLAIMING ALLOWANCES. 8 June 2017 Page 1 of.

62 In Malaysia for less than 182 days in a. On the First 5000 Next 15000. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. On the First 20000 Next. RM5000 - RM20000.

The prevailing WHT rate is 10 except where a lower rate is provided in an. Income tax is managed by the Inland Revenue Board of Malaysia which determines how much tax is paid on ones income. RM35000 - RM50000.

Not only are the. 12017 Date of Publication. Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed.

Income Tax Exemption No. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. Up to RM5000.

Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non. The most up to date rates.

Pdf Proliferation Of Hidden Income And Tax Evasion Perceptions Of Malaysian Professionals

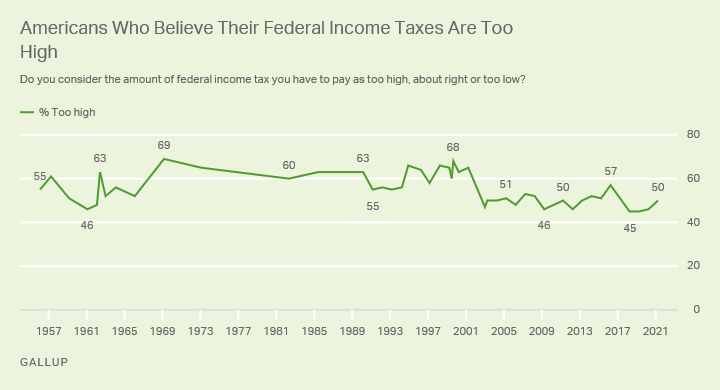

What S Driving Americans Views Of Their Taxes

Pdf The Relationship Between Tax Evasion And Gst Rate

The 2017 Tax Cuts Didn T Work The Data Prove It

Personal Income Tax Asean Asean Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Tax Refund Phishing In Malaysia How They Bypass The Two Factor Authentication Security System

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Guide 2020 Ya 2019

What Are The Sources Of Revenue For State Governments Tax Policy Center

Understanding Tax Smeinfo Portal

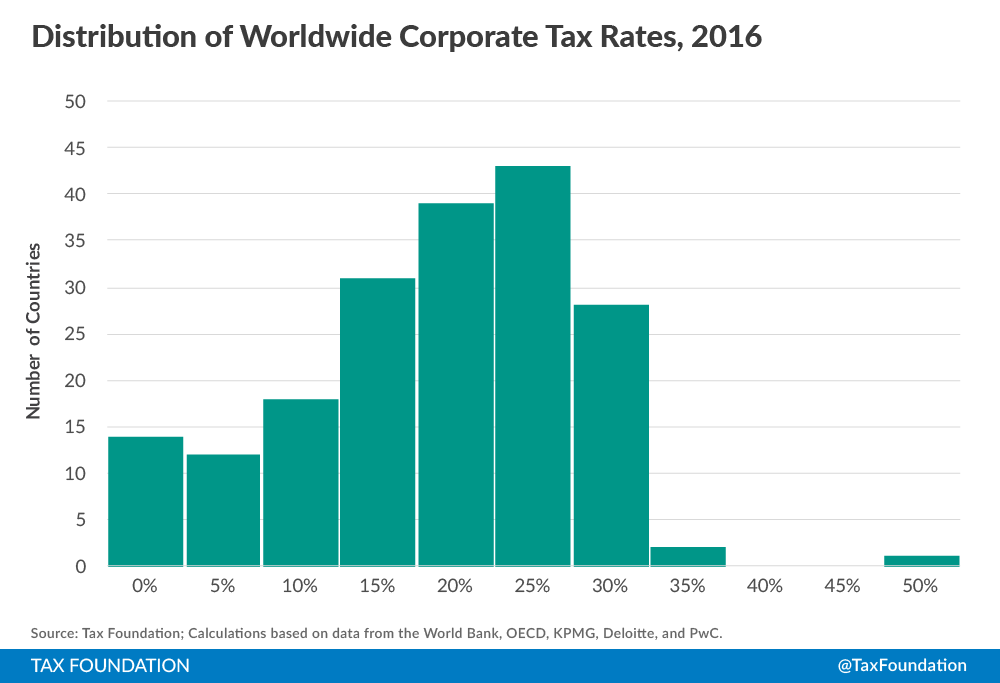

Corporate Tax Rates Around The World Tax Foundation

Should Advertisers Pay Withholding Tax On Google Facebook Advertising In Malaysia Ecinsider

Malaysia Complexity Of Tax Compliance And Reporting 2017 Statista

到底几时要报税 2017年 Income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Comments

Post a Comment