irb malaysia e filing

IHH Healthcare Bhds share price slipped below RM6 for the first time in more than a year on Thursday Sept 22 amid broader market weakness and after Indias Supreme Court refused to lift the stay on IHHs open offer for Fortis Healthcare Ltd sharesIHH fell as much as 15 sen or 246 to RM595 before closing the day at RM6 on a. The following rules and guidelines have been issued by the IRB.

Ibima Publishing Tax E Filing Adoption In Malaysia A Conceptual Model

Must contain at least 4 different symbols.

. Foreign-Sourced Income for Malaysia Taxation. ASCII characters only characters found on a standard US keyboard. Personal Income Tax Filing Requirement in Malaysia.

Select applicable form type and Year of Assessment. B Via postal delivery. 15 th April 2020.

It sets out the interpretation of the Director General of Inland Revenue in. Filing a tax assessment in Malaysia is compulsory under section 107C of the Malaysian Income Tax Act 1967. According to the Inland Revenue Boards IRB Transfer Pricing Guidelines 2012 MTPG the extent to which a TPD is to be prepared would depend on a few factors.

6 to 30 characters long. With effect from 1 st July 2022 change of address can only be made through Notification of Change in Address Form CP600B Pin 12022 and accepted either submitted by hand or by post or update online via e-Kemaskini only. Forms B P BT M MT TF TP and TJ for YA 2021 for taxpayers carrying on a business.

E-Filing is not available for Form TJ. Most companies in Malaysia are private limited companies. The 21st prosecution witness also confirmed that Shahrir had used his username and password to declare his income for those years via e-Filing on the IRB website.

The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. Its share price after doubling to seven sen in intraday trade from 35 sen a day earlier ended at an all-time low of 25 sen on profit-takingAt 5pm the counters trading volume stood. KUALA LUMPUR Sept 26.

Ziegler can be contacted via e-mail at RetirementPlanQuestionsirsgov. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. The 21st prosecution witness also confirmed that Shahrir had used his username and password to declare his income for those years via e-Filing on the IRB website.

The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Any company that is incorporated in Malaysia will be subject to the Companies Act 2016 and be regulated by the Companies Commission of Malaysia SSM.

Within 15 days after the due date. Deadline for manual Tax filing is. If the company is starting up for the first time the assessment must be filed with the IRB within 3 months from the starting date of their operations but not 30 days before the start of the base period.

This is for years of assessment 2016 to 2019In a filing with Bursa Malaysia on Monday Sept 26 DBhd said the. You may drop in at the IRB head office submit all documents and get an income tax number to proceed with. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam.

A Malaysian company is a company based in Malaysia. CIMB has around 1047 billion outstanding shares according to its Bursa Malaysia filing on Sept 14 2022. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL.

TRUST -- A trust is a legal arrangement whereby the owner of property ie. KUALA LUMPUR Sept 22. Tuan Zulkifli said that according to Section 4 of the Income Tax Act 1967 and the rules any income or profit received from other than employment must be reported to the IRB.

The government body which looks over taxing in Malaysia is the IRB Inland Revenue Board of Malaysia. 2008-12 Highlights of This Issue. We provide assignment help in over 80 subjects.

Tuan Zulkifli said that according to Section 4 of the Income Tax Act 1967 and the rules any income or profit received from other than employment must be reported to the IRB. Income Tax Transfer Pricing Rules 2012 TP Rules. Documentation should be in place by the time of filing of the tax return seven months after the FY end.

Submission via Customer Feedback Form or email is NOT ALLOWED and will not be processed. Form to be received by IRB within 3 working days after the due date. Trustee who is to hold and control the property according to the owners instructions for the benefit of a designated person or persons ie.

The government has improved the compensation for loss of employment individuals who lost their jobs between January 1 2020 to December 31 2021 are eligible for an exemption of RM20000 for every completed year of service with the same employer in the same group in. The above is subject to compliance of conditions in the guidelines which will be issued by the IRB. The first RM100000.

A Malaysian company is a company that has been legally registered in Malaysia. Therefore the profits of a local branch may be freely repatriated back to its head office without attracting further tax liabilities in Malaysia. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

The pandemic has left hundreds of thousands jobless throughout Malaysia. Damansara Holdings Bhds DBhd wholly-owned subsidiary Damansara Realty Johor Sdn Bhd DRJ has been slapped with an additional income tax bill with penalty of RM2906 million from the Inland Revenue Board IRB. All filing and payment must be done at the IRB.

KUALA LUMPUR Oct 5. Share Mail Tweet Linkedin Print Whatsapp. Click on e-Form link under e-Filing menu.

Who enter 100 in adjusted gross income on their 2007 return for the sole purpose of effectuating the electronic filing of their 2007 tax return. A e-Filing NB. User Manual e-Form ezHASiL version 33 User Manual e-Form ezHASiL version 33 8 14 e-Form Services screen will be displayed when users successfully login ezHASiL as below.

We will take care of all your assignment needs. Legal title to the trust property is vested in the. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia.

MMAG Holdings Bhds trading volume spiked past 909 million securities to its highest on record on Wednesday Oct 5 from just 716400 units on Tuesday. We are a leading online assignment help service provider. According to Paragraph 131 of the MTPG companies falling under certain thresholds mentioned below are required to prepare a comprehensive set of TPD ie.

Malaysia does not impose branch profits tax on the remittance of branch profits. At 269 CIMBs August 2022 foreign shareholding was the highest on record since the Covid-19 pandemics onset in April 2020 when the figure stood at 263 according to the financial services provider. Settlor transfers ownership to a persons ie.

However it does not need to be submitted with the tax return. EzHASiL System will display screen as below. In Malaysia both a branch and a subsidiary are generally subject to the same tax filing and payment obligations.

You may also update below details by using our.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2020 Ya 2019

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

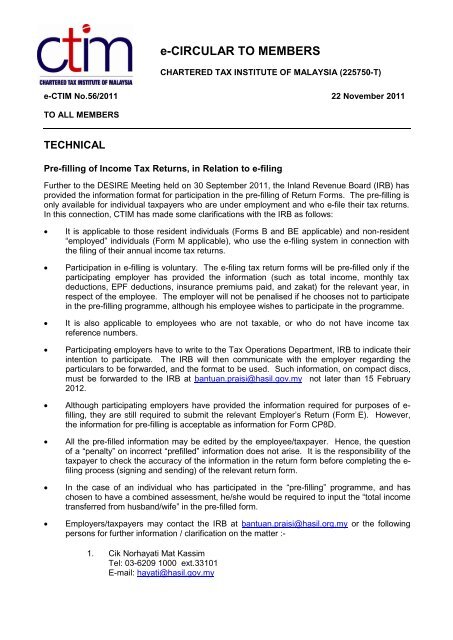

E Circular To Members Chartered Tax Institute Of Malaysia

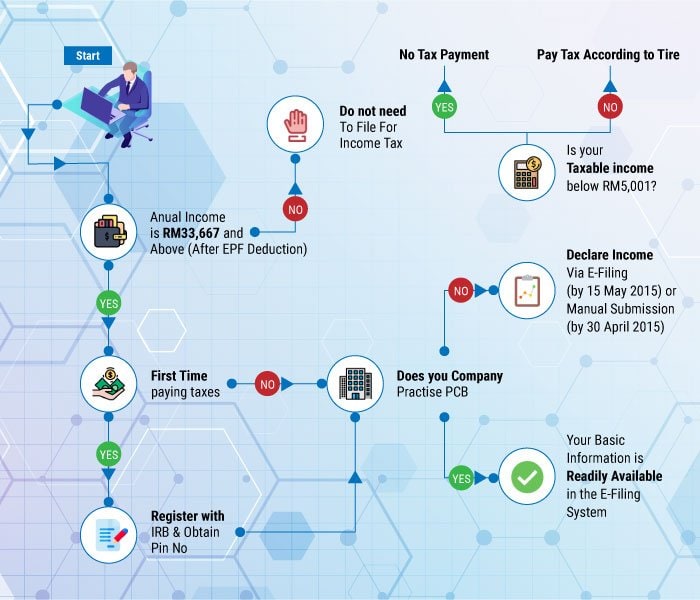

How To File Your Taxes For The First Time

Income Tax Filing Malaysia E Filing And Corporate Tax Return

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Ctos Lhdn E Filing Guide For Clueless Employees

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

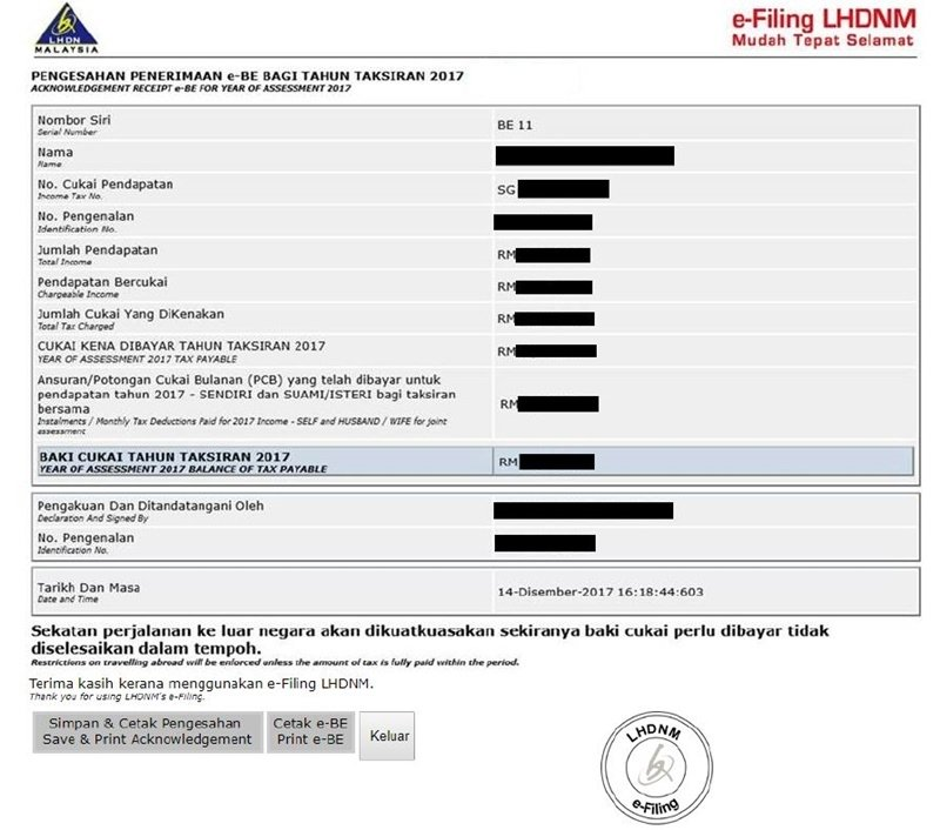

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Income Tax E Filing Guide Mypf My

Lodgement Of Rpgt Returns Via E Filing Malaysian Taxation 101

How To Step By Step Income Tax E Filing Guide Imoney

Business Income Tax Malaysia Deadlines For 2021

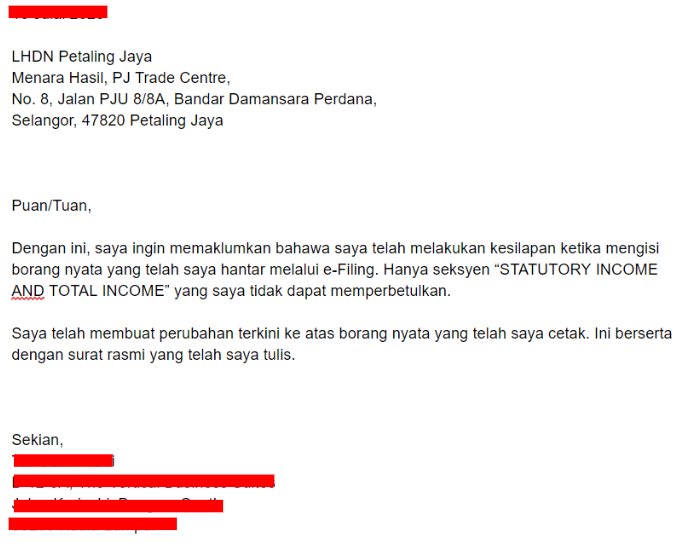

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Pdf E Government Policy Ground Issues In E Filing System

2013 Filing Programme For Income Tax Returns Malaysian Taxation 101

Comments

Post a Comment